Money Flow in Multi-Vendor and How to Control It¶

This article describes the flow of money in Multi-Vendor, and how the marketplace owners can control it. The best way to describe it is to explain the standard behavior of Multi-Vendor (without any add-ons), and how various built-in add-ons extend the functionality.

Basic Multi-Vendor (No Add-Ons)¶

By default, all the money from orders in Multi-Vendor goes to the marketplace owner. That way customers have to make only one payment for one order with products from different vendors. The order is then automatically split into multiple orders, so that each vendor could manage their own part of the original order.

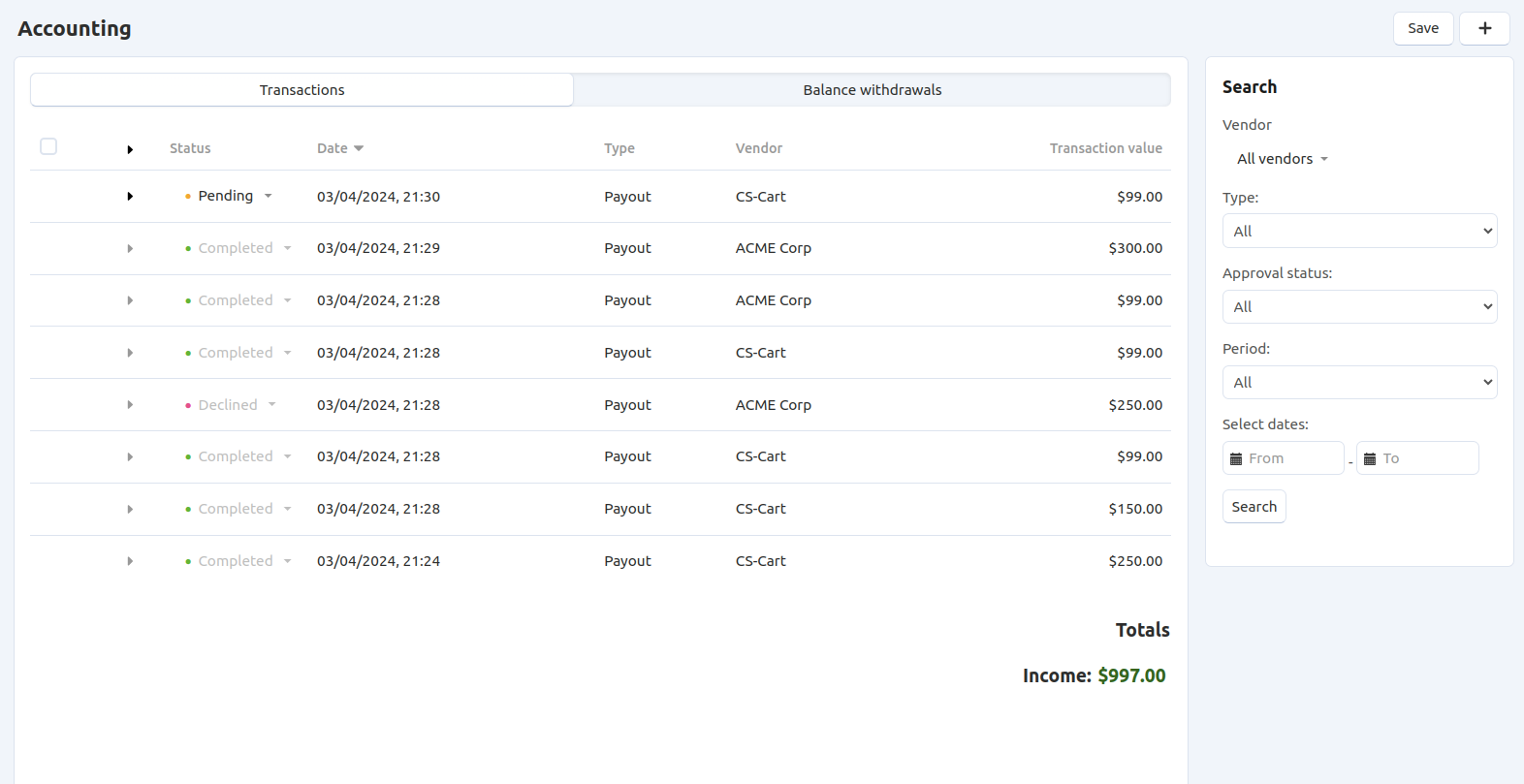

Once the marketplace owner receives the money, it’s up to them to distribute it among vendors. For that purpose, Multi-Vendor has the Accounting page. It tracks vendors’ account balance and provides the following tools for money management:

A vendor can request the withdrawal of a certain sum of money from his or her account balance. It’s up to the marketplace owner to actually transfer the money; the transfer itself isn’t performed through Multi-Vendor.

The marketplace owner can also issue payouts to take sum from a vendor’s account balance in favor of the marketplace. That’s how the marketplace makes its profits.

If a vendor’s balance is negative, the marketplace owner has to contact the vendor and resolve the situation somehow. For example, the vendor’s status can be manually changed to Pending—that way vendor’s administrators will be able to work in their administration panel, but the vendor’s products won’t appear on the storefront.

Note

Summary: By default, a Multi-Vendor marketplace receives all the money from orders. Marketplace owners then manually distribute money between vendors and manage debtors. Payments for marketplace services also have to be taken manually. Some built-in add-ons that we’ll describe below will help with automating these processes.

Vendor Plans¶

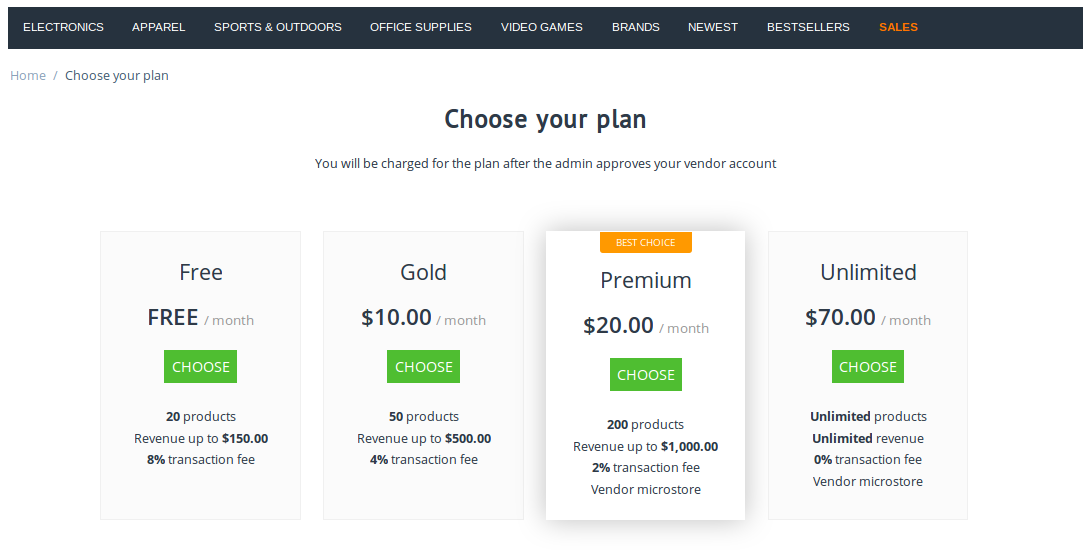

The Vendor Plans add-on helps with accounting. It offers plans for vendors with various restrictions and conditions. The add-on provides the following tools for the marketplace owners to make money off those plans:

One-time or periodic fee for using the plan.

A commission from every order of a vendor who uses the plan.

The information about fees and commissions is recorded automatically on the Accounting page. As a result, it’s easier for a marketplace owner to take periodic or transaction fees into account when distributing money among vendors.

Note

Summary: The Vendor Plans add-on doesn’t automate money distribution by itself. It only makes accounting easier by tracking one-time and periodic fees and commissions from orders.

Marketplace Payment Methods¶

Some real-time payment methods are designed specifically for marketplaces. These payment methods automatically distribute money from orders between the marketplace and the vendors right when the payment is received. The distribution of money is automatically documented on the Accounting page as completed payouts and withdrawals.

Currently, Multi-Vendor has the following payment methods with automatic money distribution (as built-in add-ons):

However, for these payment methods to work, all vendors whose products are being bought in one order must be able to receive payments via the chosen payment method.

Note

Summary: Payment methods designed for marketplaces allow to distribute money from orders automatically. These payment methods can also collect debts from vendors. The drawback is that all the vendors handling an order need to be able to receive money via the chosen payment method.

Vendor-to-Admin Payments¶

The Vendor-to-Admin Payments add-on allows you to work with debtors automatically.

- A marketplace owner sets a maximum debt and a grace period for each vendor plan.

- Vendors are able to refill their balance at any moment of time. This helps when vendors’ sales aren’t going well, but you want them to pay their fees anyway.

- If vendor’s balance reaches its minimum allowed value, he starts getting warnings to remind him to pay his debt.

- If a debtor doesn’t pay in time, a marketplace owner can automatically hide his products from the storefront, or block his admin panel. If the debt is not paid for a long time, the vendor may be automatically disabled.

Note

Summary: The Vendor-to-Admin Payments add-on helps vendors to refill their balance on marketplace. It also helps marketplace owners to motivate debtors to pay off their debts by hiding the products from storefronts or blocking the admin panel.

Direct Customer-to-Vendor Payments¶

Note

This add-on is available only in Multi-Vendor Plus and Ultimate.

The Direct Customer-to-Vendor Payments add-on frees the marketplace owners from the need to distribute money among vendors. Here’s how it works:

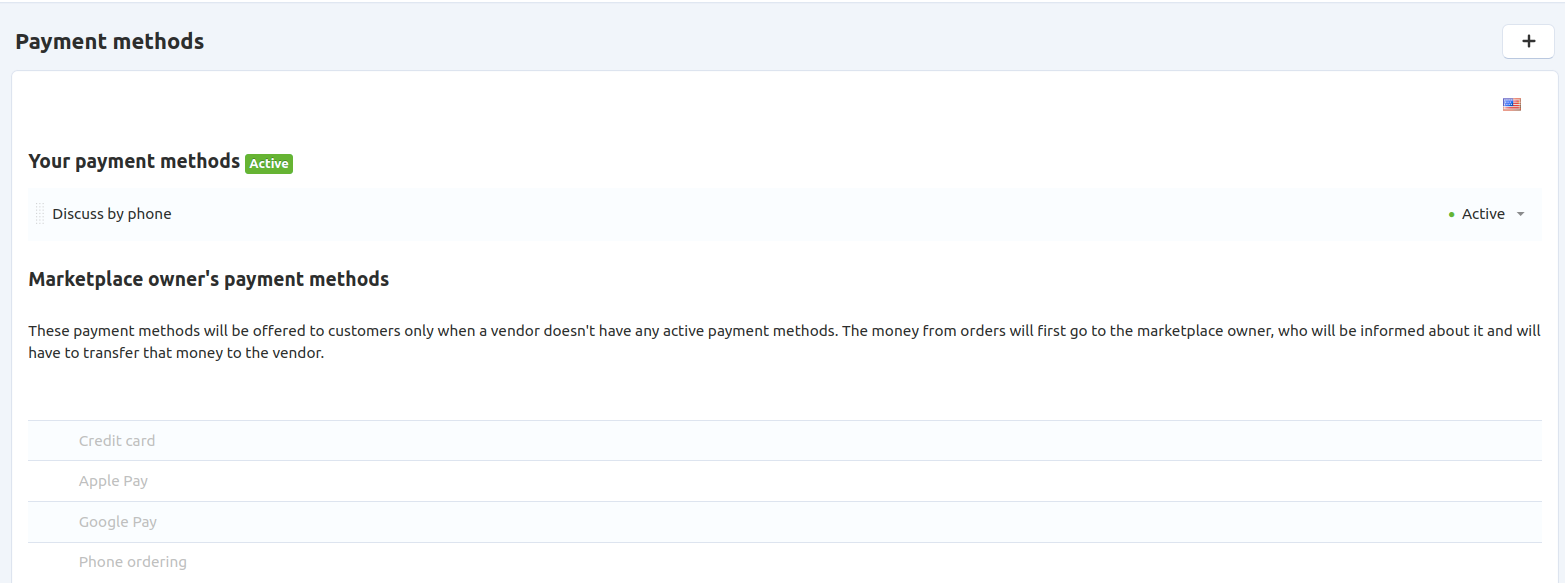

Vendors create their own payment methods.

When customers buy products from multiple vendors, they pay to each vendor separately at checkout.

The money from orders goes directly to vendors.

Hint

If a vendor doesn’t set up a payment method, then the marketplace payment methods will be offered at checkout. The money will go to the marketplace owner, who will have to transfer it to vendor.

Any transaction fees imposed by the marketplace are listed as unpaid payouts (vendor’s debt to the marketplace owner).

Direct payments to vendors work best when combined with some other add-ons mentioned above. Here is what they achieve together:

- Vendor Plans keep track of the periodic and order-specific fees that a vendor has to pay for using the marketplace.

- Direct Customer-to-Vendor Payments ensure that vendors get their money faster, and that you don’t need to bother with distributing the money among vendors.

- Vendor-to-Admin Payments helps marketplace owners to charge vendors for marketplace services, and vendors to refill their balance in time. If debtors don’t pay, restrictions are placed on their accounts, up to a full accounts disabling.

Note

Summary: The Direct Customer-to-Vendor Payments add-on changes the way your marketplace works: the money goes directly to vendors, and you don’t have to distribute it. Other add-ons ensure that vendors pay their fees to the marketplace in a timely manner.

Questions & Feedback

Have any questions that weren't answered here? Need help with solving a problem in your online store? Want to report a bug in our software? Find out how to contact us.