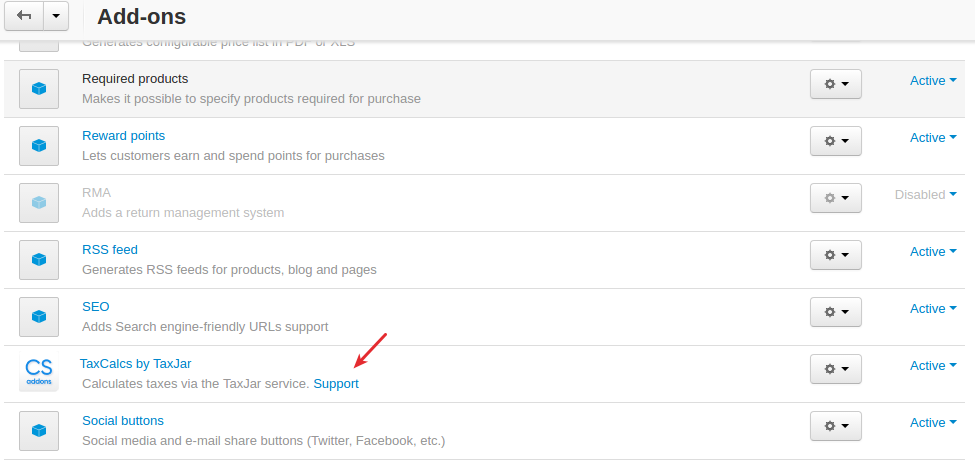

TaxJar Integrator¶

Overview¶

The TaxJar Integrator add-on integrates your store with the TaxJar service that adds automatic and comprehensive tax calculations to your orders based on the user’s state, county and city.

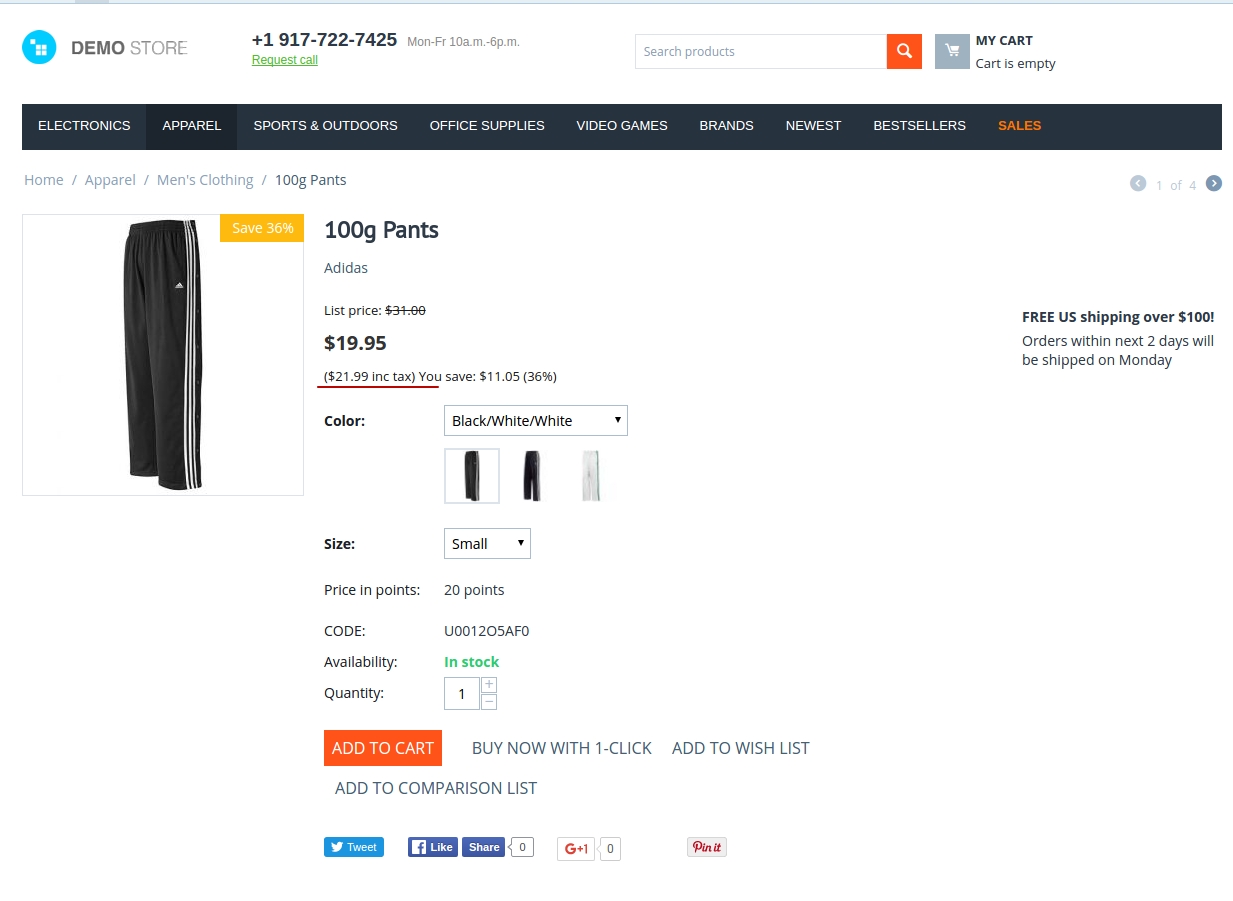

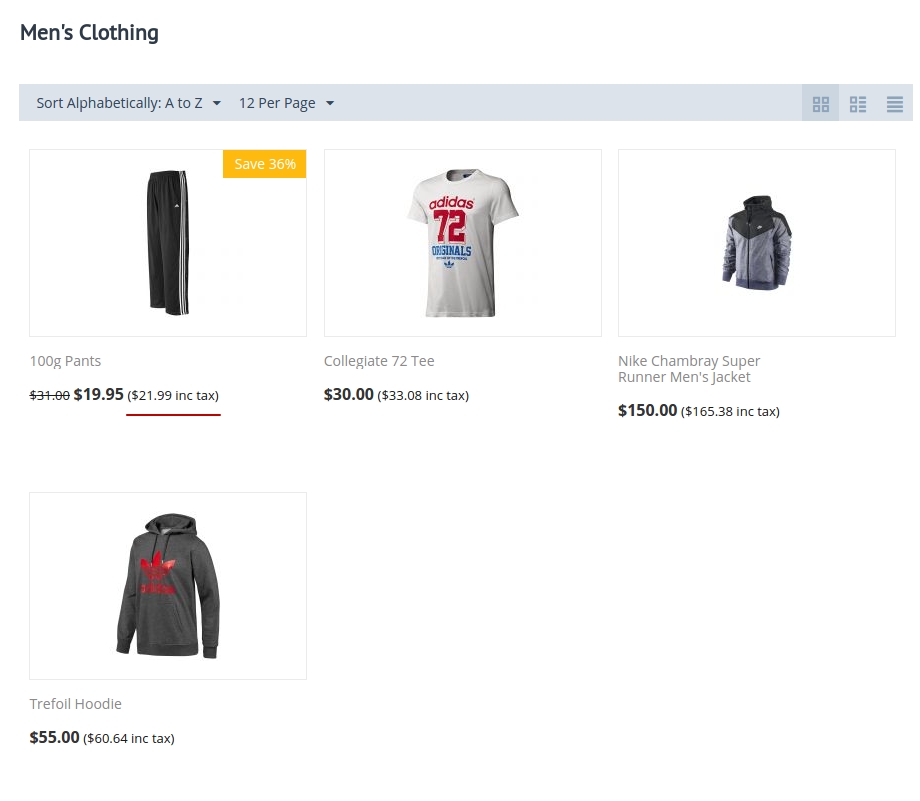

Authorized users will see product prices with included tax on product pages:

as well as on category pages:

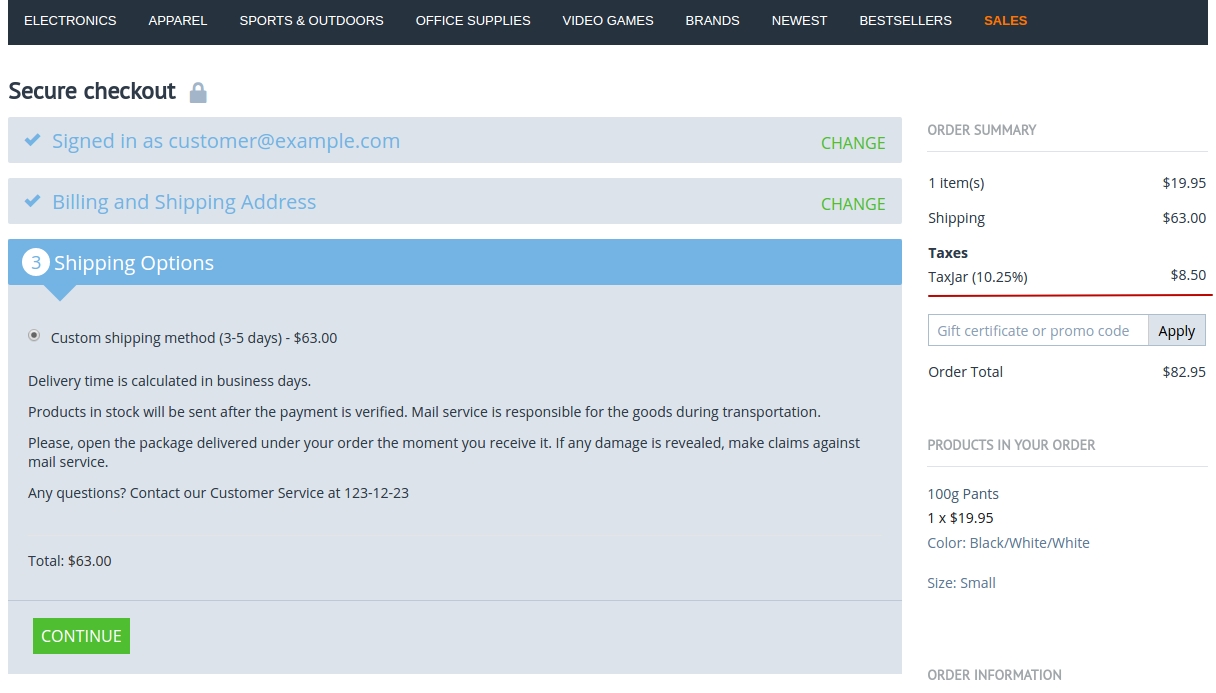

The add-on calculates how much sales tax should be collected at checkout.

Note

The service is paid. For pricing, visit this page. However, they provide a 30 day free trial.

Learn more about TaxJar from TaxJar’s Guides, Knowledgebase and video tutorials.

Features¶

- Accurate tax calculation for the USA and Canada.

- Easy to use Tax information calculator will allow you to estimate the amount of tax for the product and its shipment.

- Your vendors may use their own TaxJar account API key. It means that TaxJar transactions will be counted separately for your and their accounts.

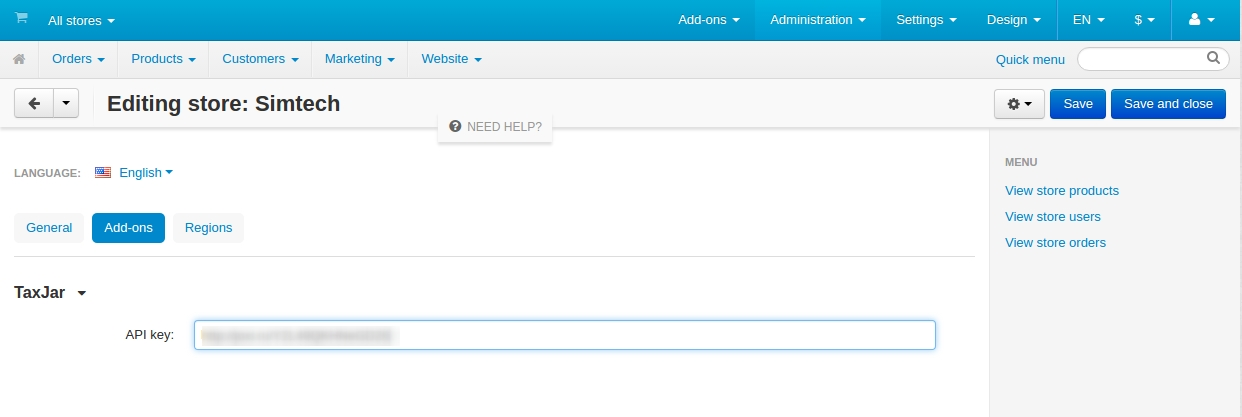

- You can use a different API key for each storefront.

- Ability to choose to show the tax in percent or in cash.

Compatibility¶

The add-on is compatible with CS-Cart and Multi-Vendor 4.9 and above, but only versions 4.12.x and above are supported. Minimum required PHP version is 7.2.

See more information about compatibility of our add-ons here.

Support¶

You are guaranteed a quality add-on supported by the future versions. If you need help, please contact us via our help desk system.

Getting TaxJar account¶

Create an account at TaxJar.

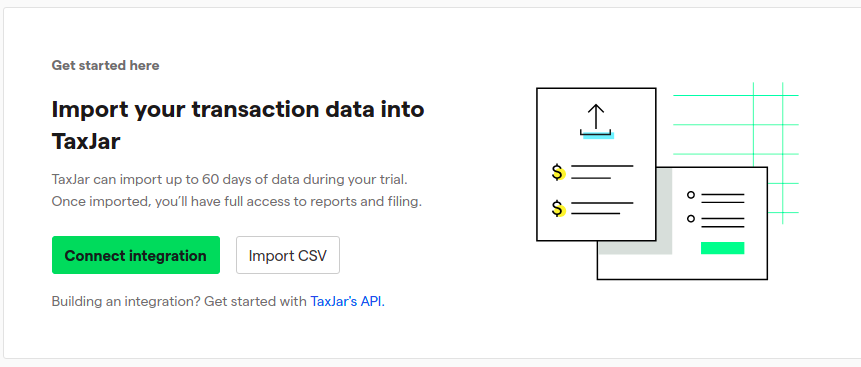

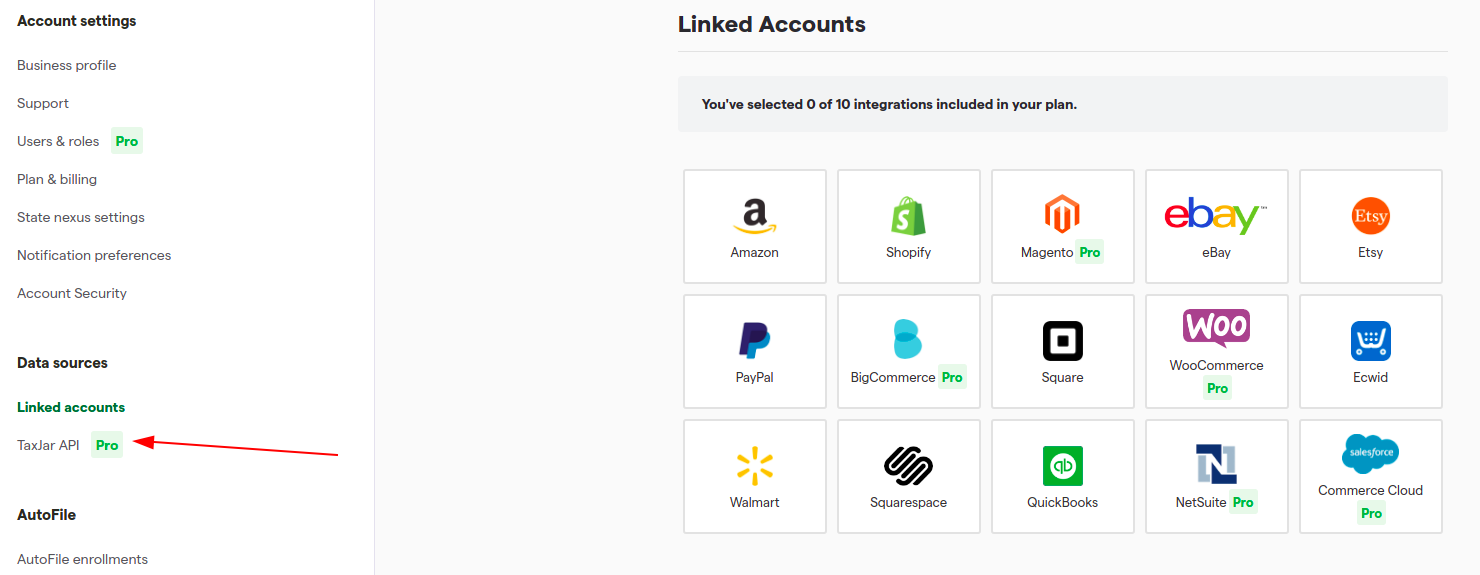

Click Connect integration button after authorization.

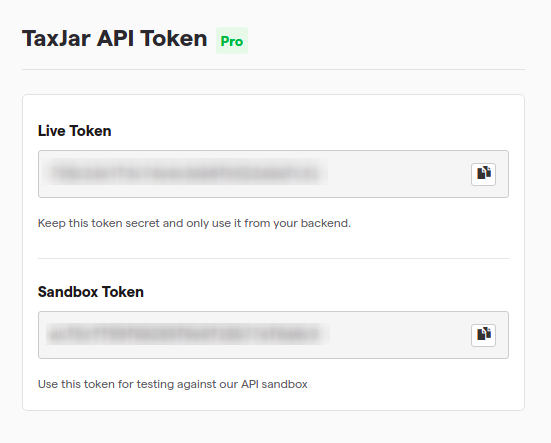

Click TaxJar API Pro to collect the token.

Select the relevant to your environment token. See the Setting up the add-on section.

Managing in the admin panel¶

Setting up the add-on¶

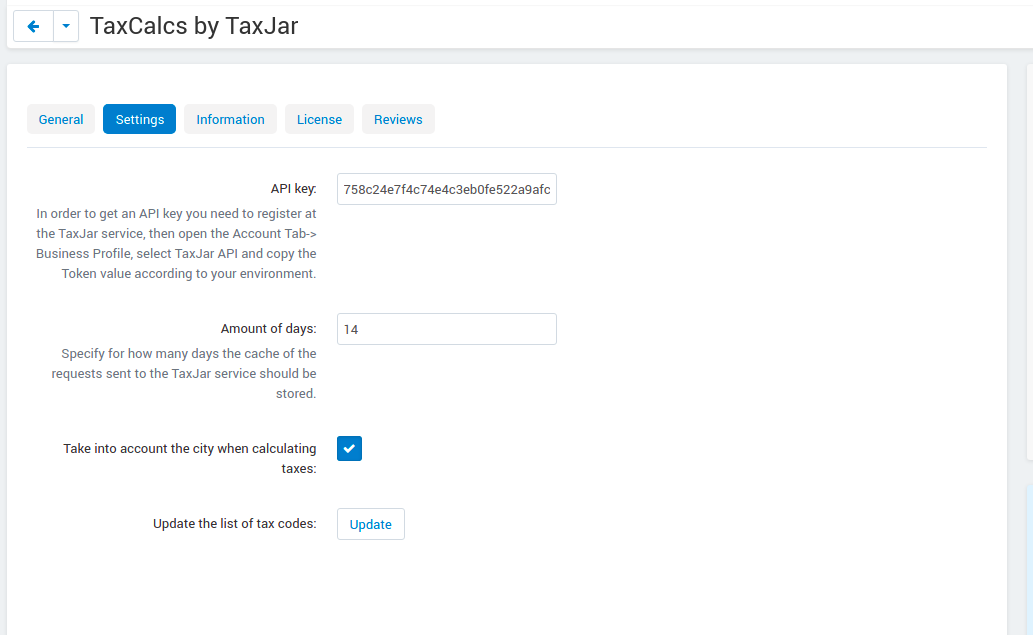

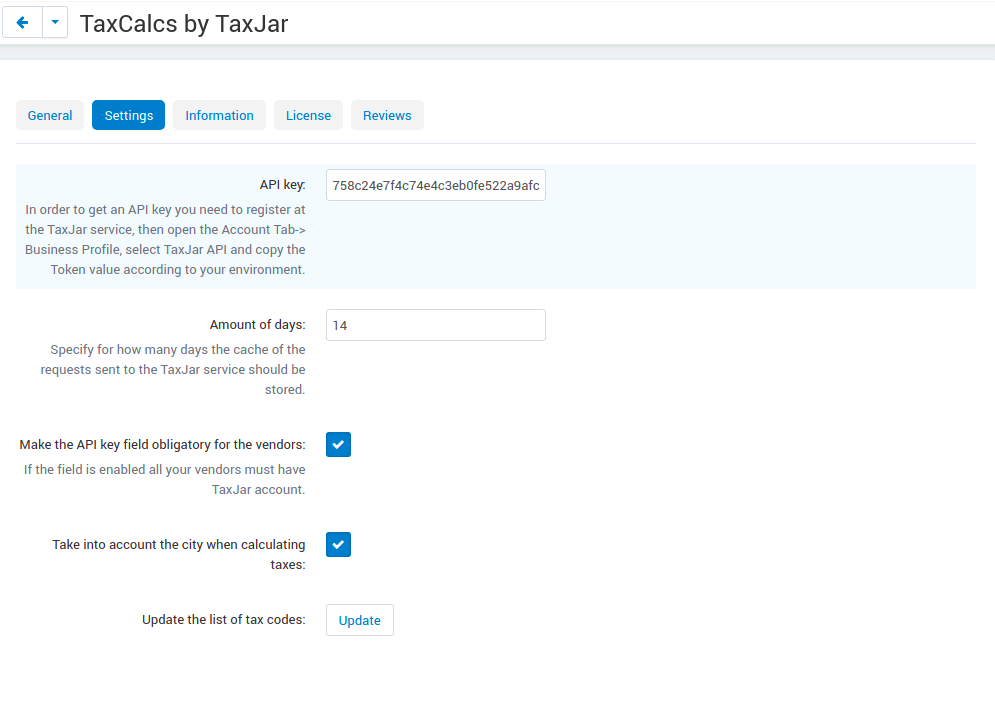

Here are available settings of the “TaxJar Integrator” add-on.

Settings for CS-Cart stores:

- API key—In order to get the API key, you need to register an account at TaxJar and generate an API key. For more information, see the Getting TaxJar account section.

- Amount of days—Specify for how many days the cache of the requests sent to the TaxJar service should be stored.

Common Settings

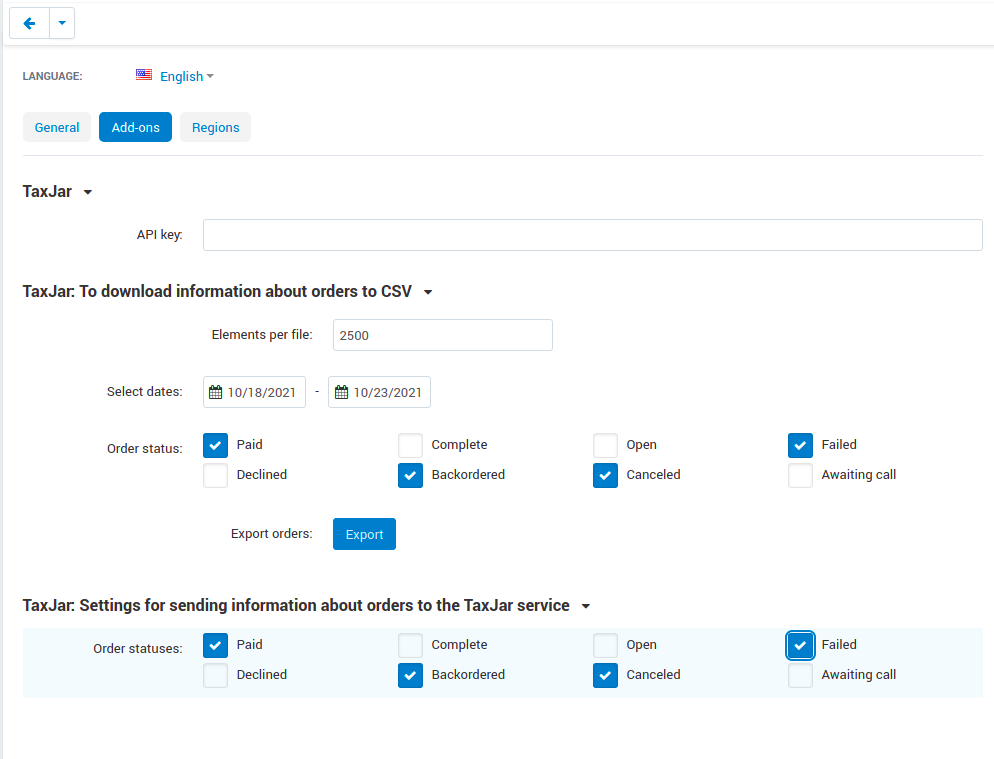

The Add-ons tab of the Storefront/Vendor Settings page contains additional setiing for the add-on

- TaxJar: To download information about orders to CSV-Allows to create a .csv order report file fand export it to TaxJar.

- TaxJar: Settings for sending information about orders to the TaxJar service-Allows to select the orders statuses for export to TaxJar.

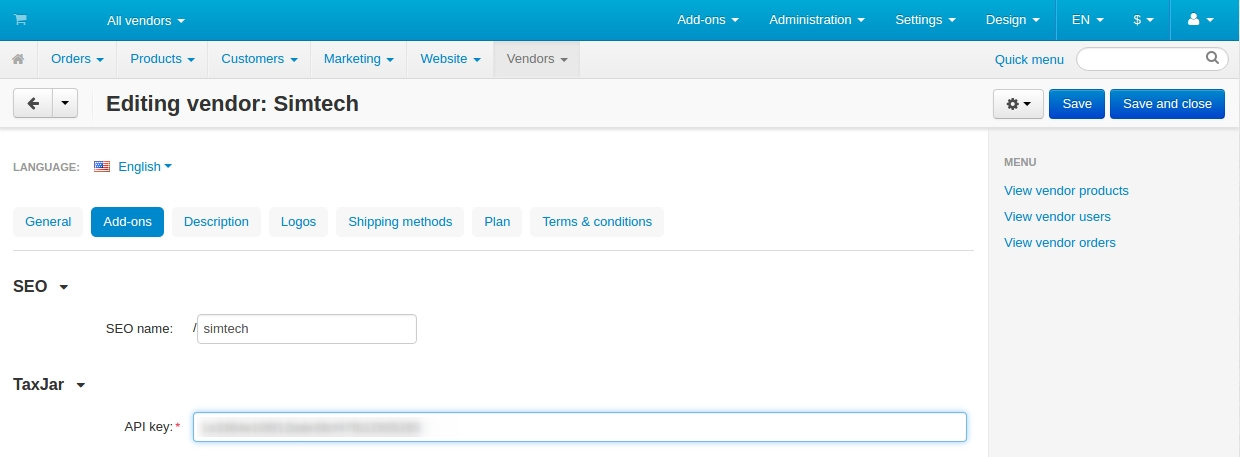

Settings for Multi-Vendor stores

- API key—In order to get the API key, you need to register an account at TaxJar and generate an API key. For more information, see the Getting TaxJar account section.

Note

In Multi-Vendor stores, each vendor should create their own TaxJar account and specify an API key on the vendor editing page in the Add-ons tab:

The same concerns CS-Cart stores with multiple storefronts—specify an API key for each store on the store editing page in the Add-ons tab:

- Amount of days—Specify for how many days the cache of the requests sent to the TaxJar service should be stored.

- Make the API key field obligatory for the vendors—If enabled, all your vendors must have a TaxJar account.

- Take into account the city when calculating taxes—If enabled, tax calculation procces will include the city where the order is shipped to. If disabled, the final amont of calculated tax will not include the city.

- Update the list of tax codes—Click the Update button to update the tax codes. As the taxes database of the service is regularly updated, you will need to update the list from time to time.

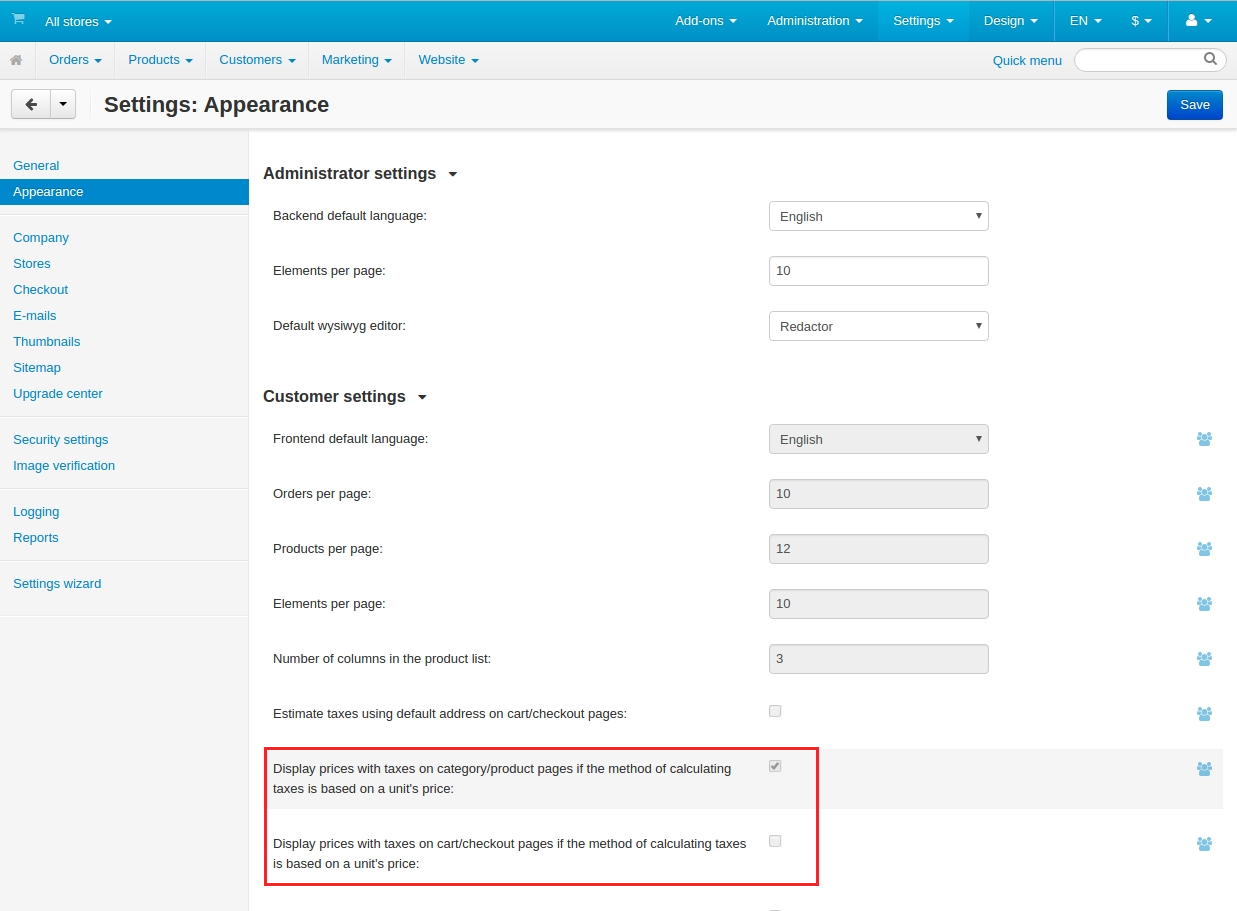

You may want to hide prices from the category/product or cart/checkout pages. If so, clear the corresponding checkboxes under Settings - Appearance - Customer settings:

Important

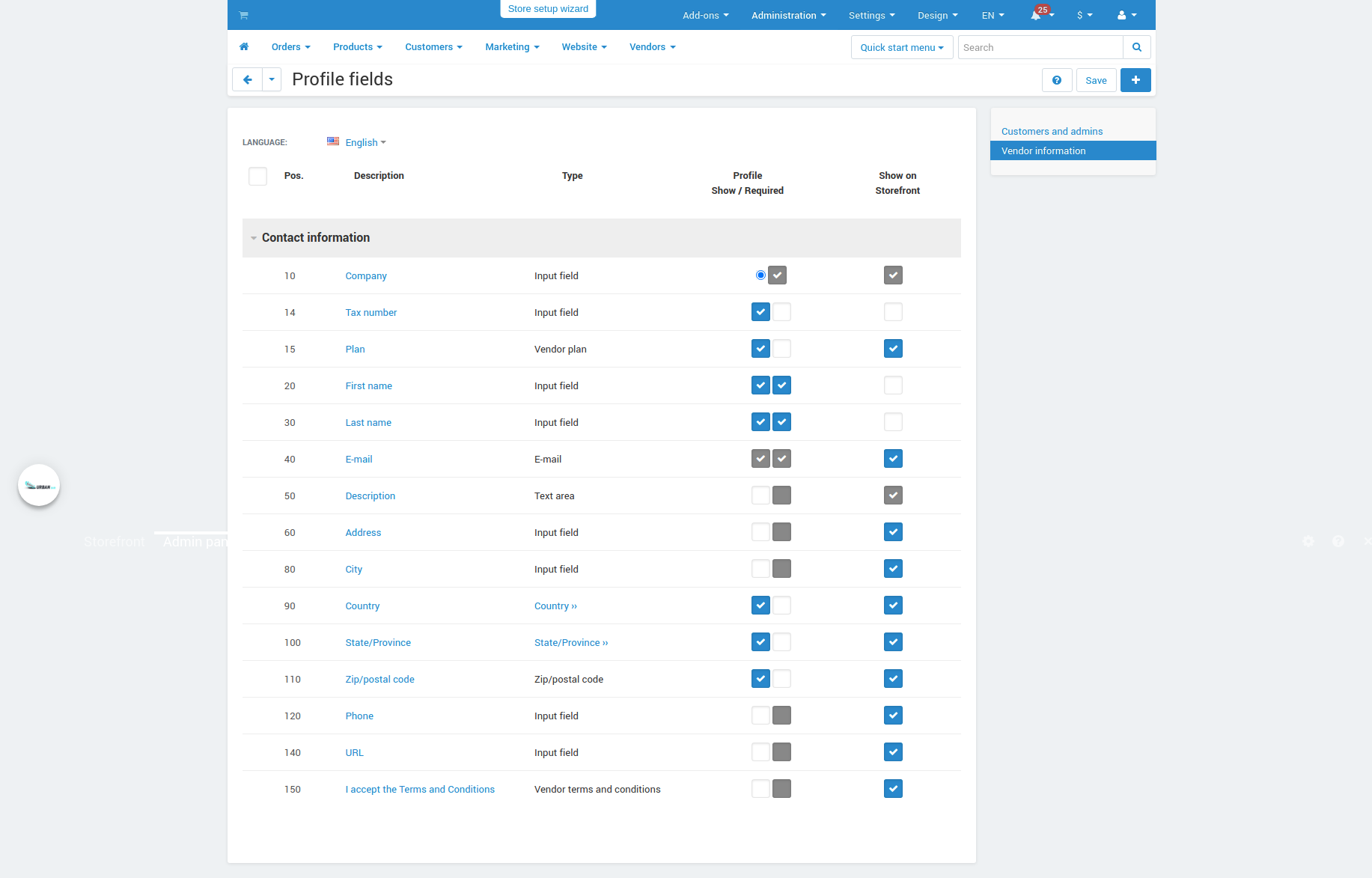

Flields ‘Country’, ‘State/Province’ and ‘Zip Code’ should be filled on the vendor profile page for correct functioning of the add-on. The relevant fields can be activated by the adminiatrator in the ‘Profile fields’ settings (Admin panel -> Administration -> Profile Fields ->Vendor information)

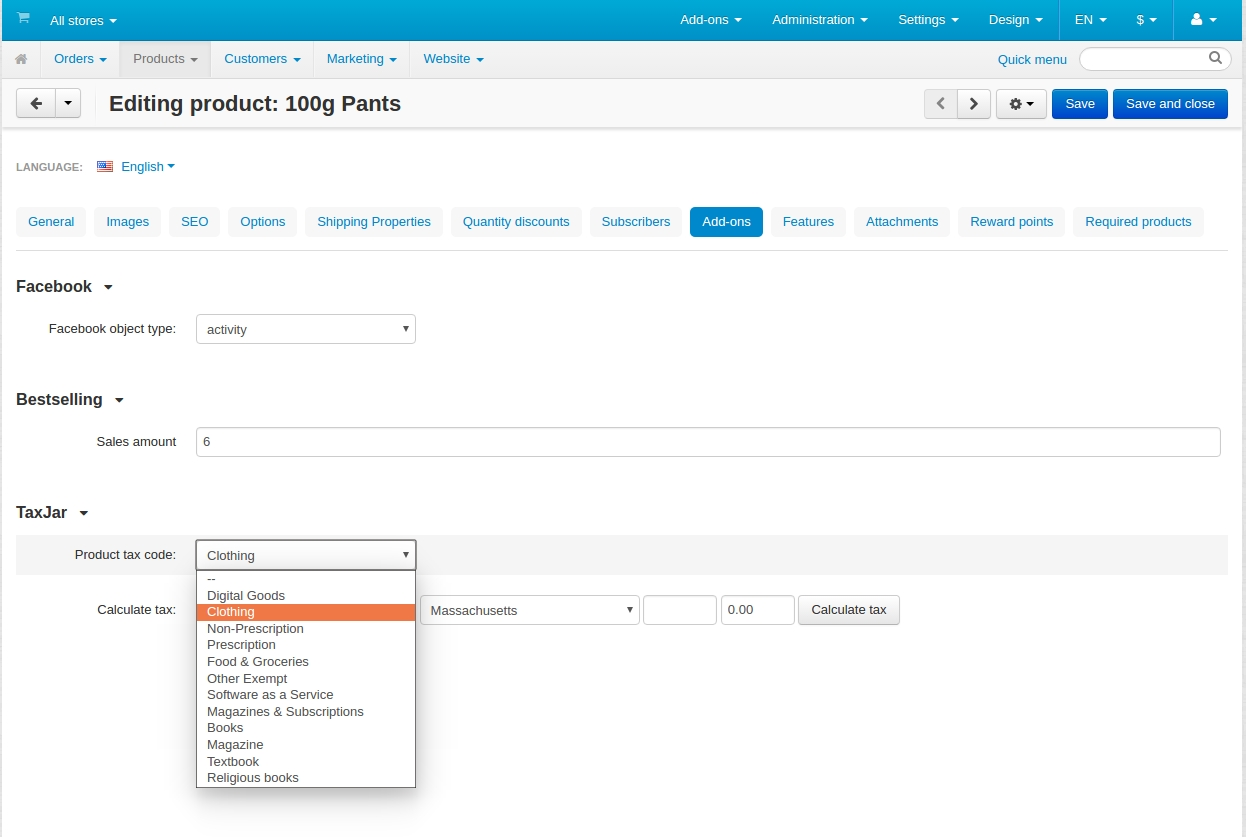

Calculating sales tax for products¶

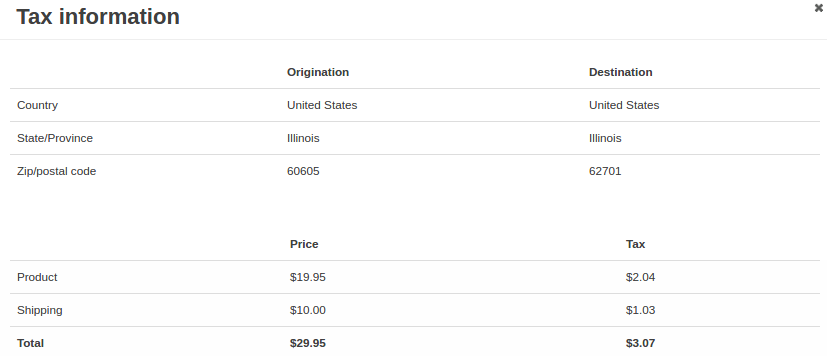

On the product editing page, you can calculate sales tax that will be added to the product cost and shipping cost. For precise calculation select a product tax code from the list, enter a country, region and valid zip code, specify the shipping cost ans click Calculate tax.

The opened pop-up will show you the required information.

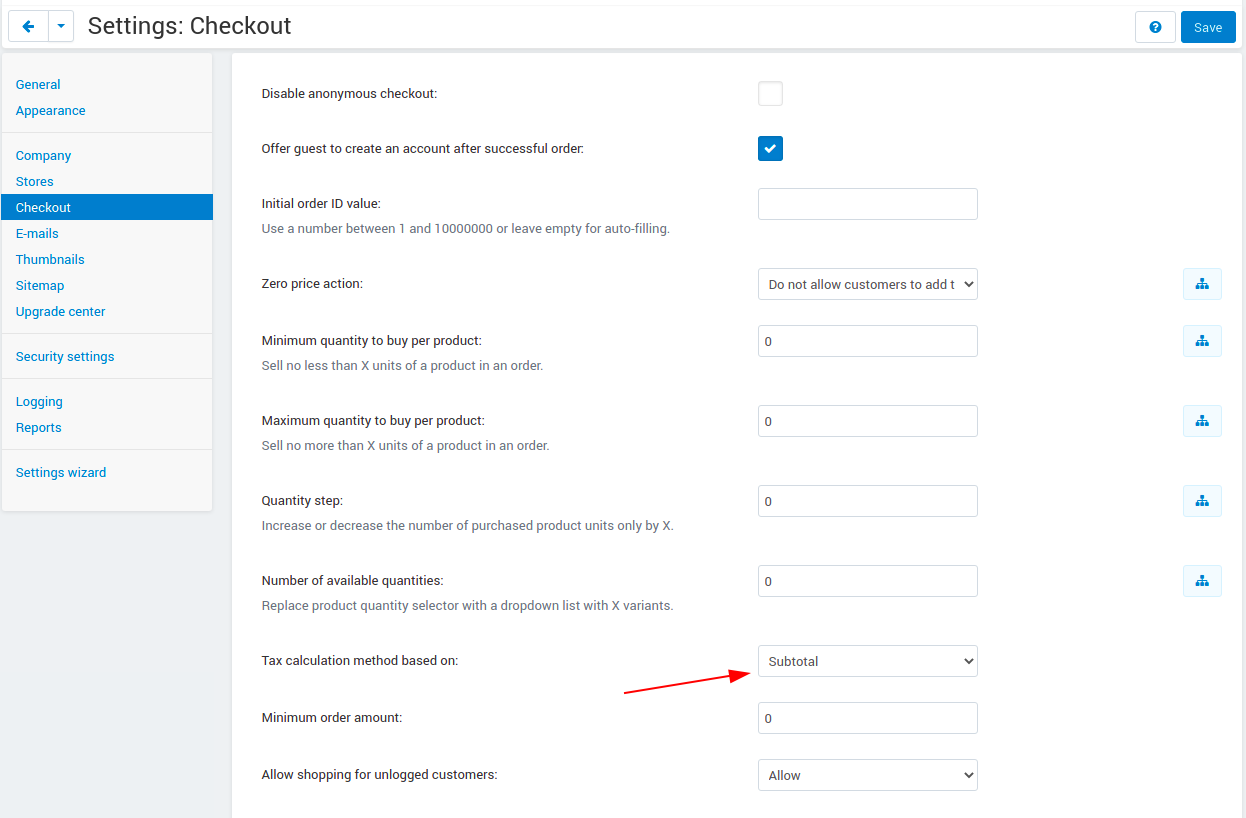

In order to make tax amount visible on the checkout select “Subtotal” option on the checkout setting page (Admin Panel -> Settings -> Checkout -> Tax calculation method based on).

Questions & Feedback

Have any questions that weren't answered here? Need help with solving a problem in your online store? Want to report a bug in our software? Find out how to contact us.